Launch, plan, and grow with Amaana Consulting, a Baltimore-based management consulting firm.

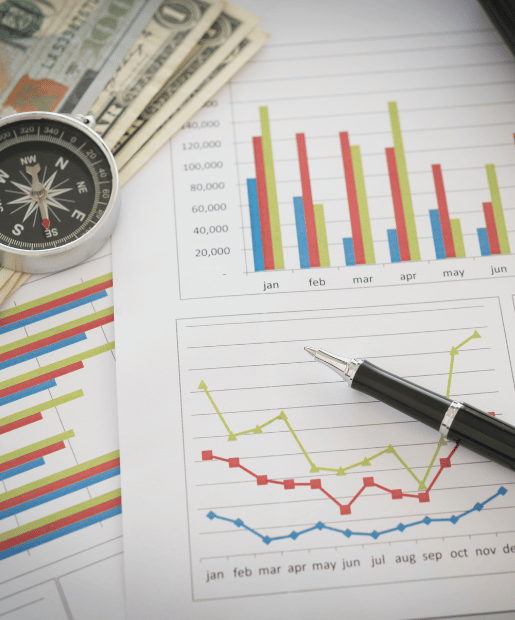

With 1,500+ hours of technical assistance delivered, and over $2.3 million in funds raised, Amaana thrives by helping nonprofit enterprises advance social justice and equity in disinvested communities.

Our project and program management background, coupled with our targeted grant writing process and approach to funder relationship cultivation, will add invaluable talent to your development team.

Launch, plan, and grow with Amaana Consulting, a Baltimore-based management consulting firm.

With 1,500+ hours of technical assistance delivered, and over $2.3 million in funds raised, Amaana thrives by helping nonprofit enterprises advance social justice and equity in disinvested communities.

Our project and program management background, coupled with our targeted grant writing process and approach to funder relationship cultivation, will add invaluable talent to your development team.

Amaana strives to make transformational investments in small community-serving nonprofits and social enterprises in Baltimore and beyond.

If you’re feelings challenged by a lack of access or expertise in core industry areas, you’ve come to the right place. We’re here to help.

We are confident that our extensive experience in advocacy and grant proposal writing, as well as our demonstrated success managing complex projects with diverse stakeholders, will make us an invaluable asset to your consulting team.

It would be our pleasure to embark on this journey with you.

Our approach is simple: Your Business Is an amaana.

Let us help you build It!

Proposal Review and Refinement

Make your application stand out and increase its ability to compete. Our grant writer will review your draft proposal and provide written and/or recorded comments and suggestions.

Drafting and Assembling

Our extensive experience facilitating the grant writing process will help you secure funding for your next venture. Let our grant writer take care of the application so you can focus on what matters most.

Program Development Support

It’s essential to make your program appealing to prospective funding partners. We can help you finalize details and justify budget requests.

We can help you develop a multi-year strategic plan that prioritizes your organization’s growth and long-term sustainability while competing for foundation and government funding.

Our professional project managers will employ various strategic planning resources that are appropriate for your organization’s size, capacity, and culture. We’ll help define the vision you have for the future of your organization while determining how to optimize existing workflows, communications practices, and decision-making processes

We’ll also help you establish a sequence for goal attainment and offer resources and guidance tailored to your organization, setting you up for achievable success.

We thrive on strengthening our clients’ competitive edge to achieve their developmental goals.

We’re here to help coach your organizational members as they transition to leadership and governance roles.

We’ll train new leadership to facilitate the execution of your organization’s vision, values, and strategy by building consensus and growing the capabilities of others.

Our advanced experience enables our team of expert consultants to provide hyper-personalized coaching and tailored development strategies to unleash leadership potential.

We’re here to help you bridge the gap, overcome challenges, and advance equity. It’s time to invest in your organization, project, or program.

Book a call with or get in touch for consultative guidance on strategic planning, data gathering, the grant writing process, goal setting, or progress monitoring.

We look forward to connecting with you!

Amaana Consulting is committed to a continual process of listening, reflection, and refinement to best meet the needs of the organizations and entrepreneurs we serve. Founder and Principal Kirin G. Smith has extensive experience managing complex multi-million-dollar contracts, overseeing multidisciplinary project teams, facilitating targeted community outreach, and working as a grant writer for local nonprofit organizations.

The vast majority of our work products include internal assessments and reports that contain sensitive and proprietary information. To be responsive to requests for work products while honoring confidentiality agreements, we may, at our discretion, share redacted materials and/or record a narrated video to provide insight into our services and work products. We are happy to provide contact information for clients and professional references, upon request. Get in touch with us to learn more.

The short answer is yes, and no. Most government, corporate, and foundation grants for nonprofits require that an applicant has been designated as tax-exempt under the IRS codes. This designation gives donors and grantmakers the ability to deduct their contributions to your organization. It also provides a measure of accountability if your organization is required to file tax returns. There are different types of tax-exempt entities, the most common being 501(c)(3) and 501(c)(4) in our work. You can learn more about exempt organization types HERE. Some, but not all, grantmakers allow the use of a fiscal sponsor to serve as the tax-exempt entity on your behalf. Before you enter into a fiscal sponsorship agreement, be sure you understand your obligations under the contract including limitations on solicitations, payment policies, and reporting requirements. Book a discovery call to learn more.

According to the National Network of Fiscal Sponsors, fiscal sponsorship “generally entails a nonprofit organization (the ‘fiscal sponsor’) agreeing to provide administrative services and oversight to, and assume some or all of the legal and financial responsibility for, the activities of groups or individuals engaged in work that relates to the fiscal sponsor’s mission. Fiscal sponsors are tax-exempt, charitable ventures that, according to a recent IRS report ‘have the ability to receive charitable contributions for specific projects, the infrastructure to ensure compliance with applicable federal and state laws and adequate internal controls to ensure that the funds will be used for the intended charitable purposes.'” Many donors and grantmakers require recipients of charitable contributions to be tax-exempt under federal law. If your organization has not yet received federal tax exemption status, or you do not wish to pursue federal tax exemption for your program or projects, fiscal sponsorship may be an option for you. We can help you assess your options with a consultation.

No, our fees are based on the value of the services we provide. It is also against the code of ethics from the Association of Fundraising Professionals for development professionals to accept compensation based on a percentage of grant awards. You can read more about AFP’s Code of Ethics here or learn more during a discovery call.

FTE refers to full-time equivalency, which is a measure of hours worked in relation to a full-time standard, in a given period. It is not a headcount of your staff. If your organization or business received a PPP (Payroll Protection Program) Loan, FTE calculations were required to establish eligibility for loan forgiveness under the CARES Act. We can develop custom spreadsheets to help you calculate FTEs for your personnel. Get in touch with us here.

This is a very common question. As of the time of writing, the IRS does not make copies of 990-N form available on its website. The only documentation provided is acceptance of your submission. For more information on what documentation is available on the IRS website, take a look at our FAQ Series Video on 990 Documentation or book a discovery call.

The vast majority of our work products include internal assessments and reports that contain sensitive and proprietary information. To be responsive to requests for work products while honoring confidentiality agreements, we may, at our discretion, share redacted materials and/or record a narrated video to provide insight into our services and work products. We are happy to provide contact information for clients and professional references, upon request. Get in touch with us to learn more.

The short answer is yes, and no. Most government, corporate, and foundation grants for nonprofits require that an applicant has been designated as tax-exempt under the IRS codes. This designation gives donors and grantmakers the ability to deduct their contributions to your organization. It also provides a measure of accountability if your organization is required to file tax returns. There are different types of tax-exempt entities, the most common being 501(c)(3) and 501(c)(4) in our work. You can learn more about exempt organization types HERE. Some, but not all, grantmakers allow the use of a fiscal sponsor to serve as the tax-exempt entity on your behalf. Before you enter into a fiscal sponsorship agreement, be sure you understand your obligations under the contract including limitations on solicitations, payment policies, and reporting requirements. Book a discovery call to learn more.

According to the National Network of Fiscal Sponsors, fiscal sponsorship “generally entails a nonprofit organization (the ‘fiscal sponsor’) agreeing to provide administrative services and oversight to, and assume some or all of the legal and financial responsibility for, the activities of groups or individuals engaged in work that relates to the fiscal sponsor’s mission. Fiscal sponsors are tax-exempt, charitable ventures that, according to a recent IRS report ‘have the ability to receive charitable contributions for specific projects, the infrastructure to ensure compliance with applicable federal and state laws and adequate internal controls to ensure that the funds will be used for the intended charitable purposes.'” Many donors and grantmakers require recipients of charitable contributions to be tax-exempt under federal law. If your organization has not yet received federal tax exemption status, or you do not wish to pursue federal tax exemption for your program or projects, fiscal sponsorship may be an option for you. We can help you assess your options with a consultation.

No, our fees are based on the value of the services we provide. It is also against the code of ethics from the Association of Fundraising Professionals for development professionals to accept compensation based on a percentage of grant awards. You can read more about AFP’s Code of Ethics here or learn more during a discovery call.

FTE refers to full-time equivalency, which is a measure of hours worked in relation to a full-time standard, in a given period. It is not a headcount of your staff. If your organization or business received a PPP (Payroll Protection Program) Loan, FTE calculations were required to establish eligibility for loan forgiveness under the CARES Act. We can develop custom spreadsheets to help you calculate FTEs for your personnel. Get in touch with us here.

This is a very common question. As of the time of writing, the IRS does not make copies of 990-N form available on its website. The only documentation provided is acceptance of your submission. For more information on what documentation is available on the IRS website, take a look at our FAQ Series Video on 990 Documentation or book a discovery call.